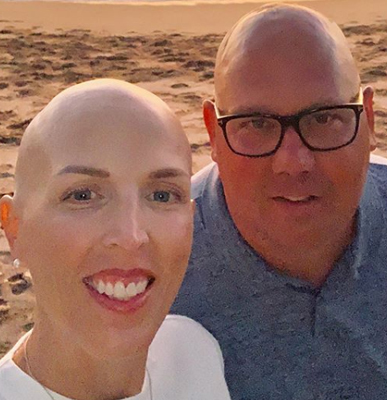

In early 2018, Heather Brinkerhoff was busy with her three-year-old son and building her personal training business; her husband, Jason, was an emerging artist with several well reviewed gallery shows. Their young family lived in a “fixer upper” in the Bay Area, California, in a two bedroom with enormous potential but requiring Jason to do lots of work to make it the home of their dreams. In May 2018, Jason noted increasing headaches and was ultimately diagnosed with a glioblastoma multiforme. Months later, while still dealing with the stress of neurosurgery, radiation and chemotherapy for her husband, Heather noted increasing abdominal pain. In January 2019, she was diagnosed with pancreatic cancer. A young family faced with two devastating cancer diagnoses would be overwhelmed no matter what, but the financial burden of cancer hit the Brinkerhoffs particularly hard.

Heather Brinkerhoff took time between chemotherapy appointments to share part of her story:

I just want to start with saying that my husband and I both have always had health insurance. But we’re a young family, and we’re both self-employed. In the last 18 months, we were hit with two horrible cancers, two huge surgeries, radiation, chemotherapy…all while our house was — literally — in pieces. The first thing I realized is that our first insurance plan was tied to a hospital system that just wasn’t able to care for me. I had a complicated hospitalization in January with jaundice and pain, I was in rough shape. I needed to get started with treatment pretty fast. Due to the complexities of my case, it just wasn’t happening and that was very scary. I ended up transferring to another hospital and they were able to get me started quickly, but it was expensive, thousands of dollars. By doing the best thing for my health, and to treat my cancer, I ended up on the hook for $35,000. I recently found out that I was sent to collections for this.

Hilariously, they said that if I didn’t have insurance, they could provide a 75% discount. But since I’m insured, this is just all on us. They had sent these letters to let us know we were delinquent, but there’s only so much you can deal with when you’re sick and your husband is sick. There’s only so much energy you have to fight these battles. Ironically, now we have a better health insurance plan which mostly covers my treatment at Stanford, it’s really that first hospitalization that is still weighing on us.

We’re really dependent on the kindness and generosity of friends and family now. My friend pays hundreds of dollars every month for our health insurance premium; we live in a family friend’s house as our house is still half-constructed. Otherwise we’d be homeless or living in my mom’s basement in another state. My sister set up a Go Fund Me campaign to help with our expenses. That has been a lifesaver. It’s so hard to plan. I had another hospitalization due to stent migration and complications. And then of course my surgery and that recovery. I honestly don’t know how people survive without the type of support we’ve been blessed with.

It’s not just obvious costs like surgery and hospitalizations, it starts with little things. Like my doctor recommended acupuncture because he said it could help, but my insurance doesn’t cover it. For diarrhea, I have tried so many treatments (supplements, diet, medication). You’re so desperate, you’ll do anything, but they each cost money, $20 here, $40 there. My husband has brain cancer and makes a lot of mental errors, they can have significant financial costs. The wrong date or city for hotels and airplane tickets for when our family comes to help, late fees for overdue payments that he forgot about. Sometimes companies are sympathetic when you explain the problem, that is, if you have the bandwidth to make the call. My husband is still trying to work in his art studio, sell art, make money; contributing and being independent is important to him. Unfortunately, he can’t drive now and we spend hundreds of dollars every month on Ubers. He needed glasses because of vision changes due to his brain tumor, but we don’t have vision insurance and it was so expensive. It’s hard to anticipate these types of costs.

And I cannot even tell you about what this means for our son. We are trying to keep his life as consistent as possible but it’s hard. He’s in childcare more now than ever because of our medical appointments. Forget about a college savings account for him, I just keep a list of people who we think will help with covering his immediate needs.

The financial burden on patients is staggering. ASTRO expresses its deepest appreciation to Heather for sharing her story and to Dr. Fumiko Chino for documenting it.